Share investment Apr 16 Part 2

(continue from Part 1)

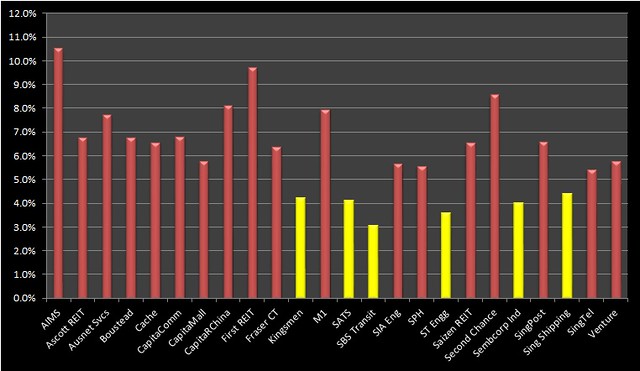

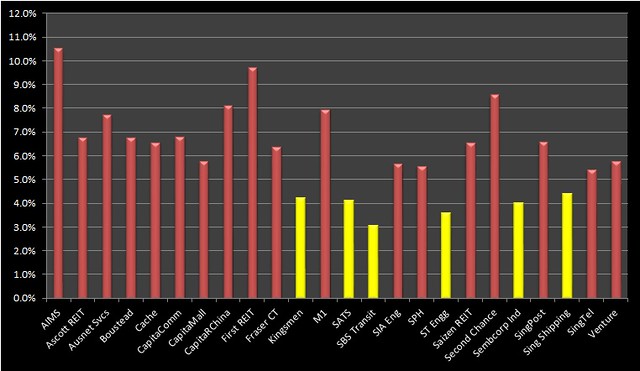

Here are the dividend yields on cost for shares that have paid out dividends equivalent to at least a year:

There are now 6 share counters with dividend yield below my desired 5%. Gosh, I'm so tempted to sell the remaining small number of SBS Transit shares since I had held them for many years already. As for the other 4, I'll continue to monitor, especially ST Engineering.

The overall dividend yield on cost weighted by invested amount remains 6.0%. Hope it'll at least stay that way or, better yet, improve.

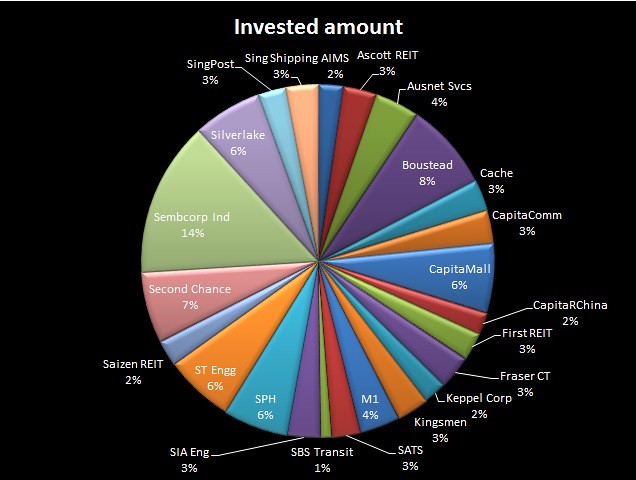

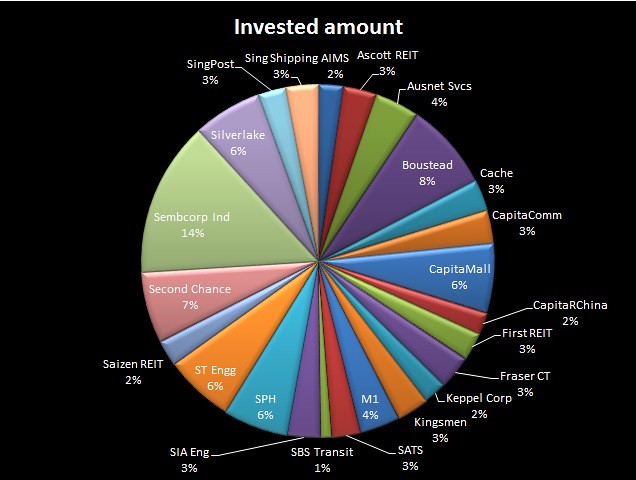

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

Clearly, Sembcorp Industries stands out the most. Hopefully it'll be in the black soon for me to sell off some shares. Not comfortable with any counter with more than 10% of the invested amount.

Here is the average cost of each share counter compared to its then prevailing price as at 16 April 2016:

Share market is quite bad now, with most share counters' prices lower than a year ago. Note that Saizen REIT's share price has fallen dramatically due to significant return in capital (refer to Part 1).

Here are the dividend yields on cost for shares that have paid out dividends equivalent to at least a year:

There are now 6 share counters with dividend yield below my desired 5%. Gosh, I'm so tempted to sell the remaining small number of SBS Transit shares since I had held them for many years already. As for the other 4, I'll continue to monitor, especially ST Engineering.

The overall dividend yield on cost weighted by invested amount remains 6.0%. Hope it'll at least stay that way or, better yet, improve.

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

Clearly, Sembcorp Industries stands out the most. Hopefully it'll be in the black soon for me to sell off some shares. Not comfortable with any counter with more than 10% of the invested amount.

Here is the average cost of each share counter compared to its then prevailing price as at 16 April 2016:

Share market is quite bad now, with most share counters' prices lower than a year ago. Note that Saizen REIT's share price has fallen dramatically due to significant return in capital (refer to Part 1).

Comments