Share investment Apr 18 Part 2

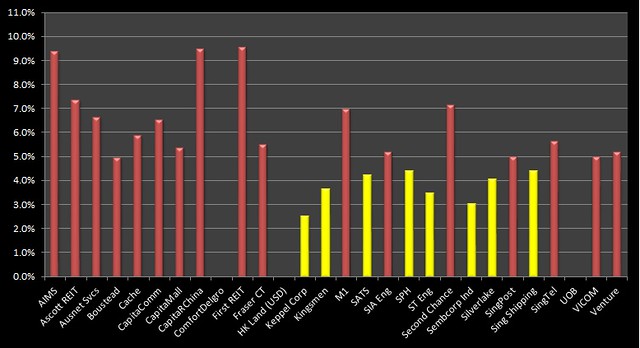

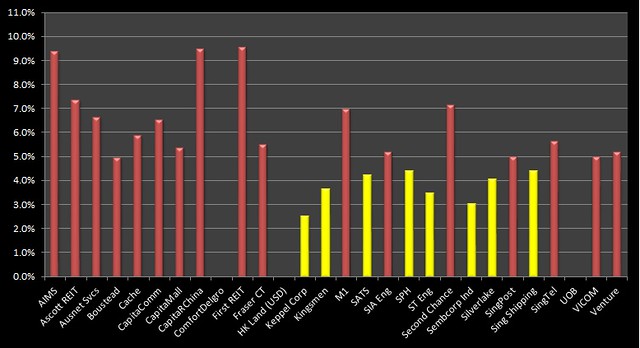

Here are the average dividend yields on cost for shares that have paid out dividends:

Note that I initiated position in ComfortDelgro, HongKong Land and UOB just recently and so I have yet to receive dividends from these companies.

The overall dividend yield on cost weighted by invested amount is 5.8%, excluding the 3 share counters mentioned above.

There are 8 share counters with dividend yield (on cost) less than 5% (number of consecutive years of this low yield in bracket):

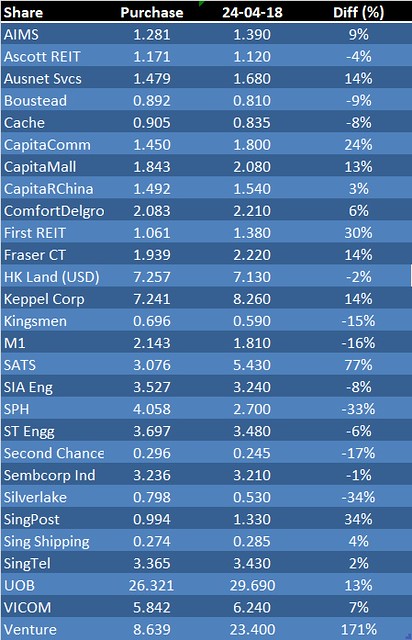

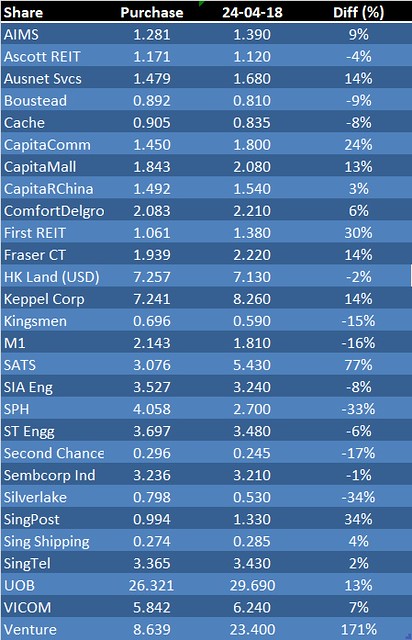

Share that had increased significantly is Venture (171%) and the one that had fallen significantly is Silverlake (-34%).

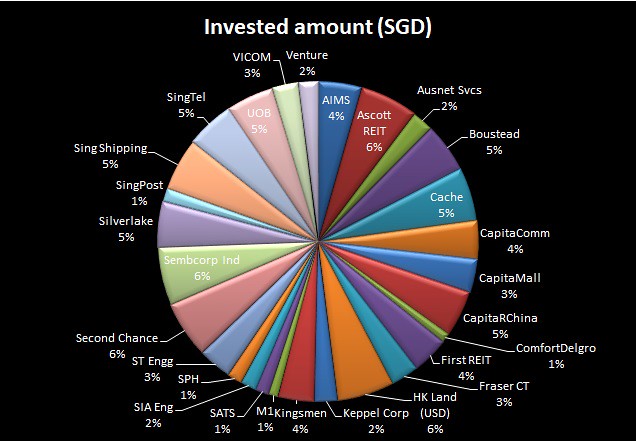

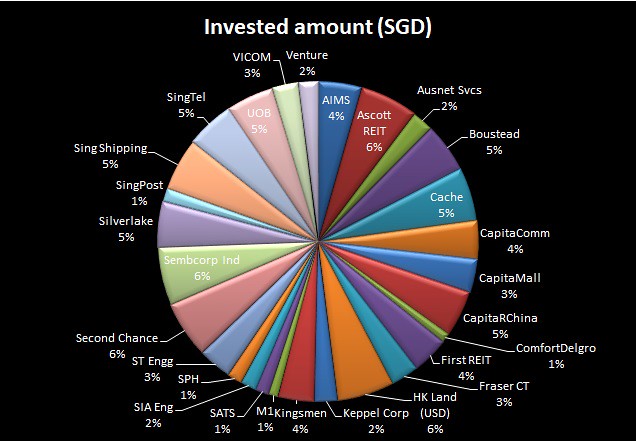

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

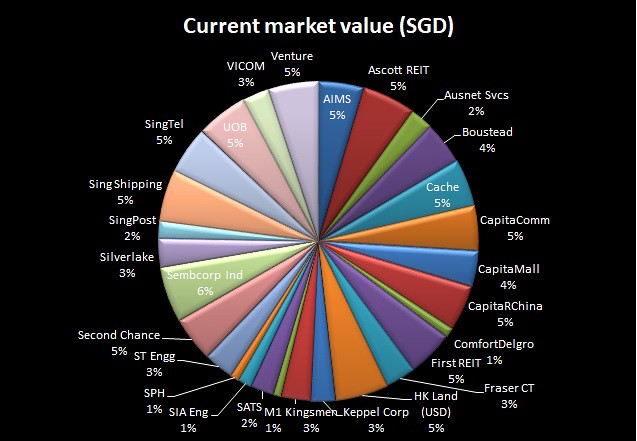

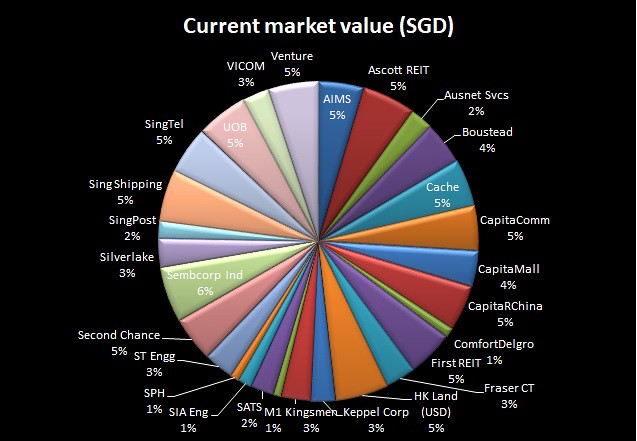

Here's the breakdown of my portfolio according to market value as at 24 April 2018:

I'm quite happy with the current composition as there's no one share counter that appears to dominate my portfolio.

Note that I initiated position in ComfortDelgro, HongKong Land and UOB just recently and so I have yet to receive dividends from these companies.

The overall dividend yield on cost weighted by invested amount is 5.8%, excluding the 3 share counters mentioned above.

There are 8 share counters with dividend yield (on cost) less than 5% (number of consecutive years of this low yield in bracket):

- Keppel Corp (2)

- Kingsmen (4)

- SATS (3)

- SPH (2)

- ST Eng (4)

- Sembcorp Ind (4)

- Silverlake (2)

- Sing Shipping (3)

Hmmm maybe I'll sell if its average dividend yield is less than 5% for 5 consecutive years? 10 consecutive years? I'm not sure. Note that this is "average" yield and so even if the company starts to improve its current dividend yield, it takes time for this average figure to cross the 5% threshold.

Here is the average cost of each share counter compared to its then prevailing price as at 24 April 2018:

Share that had increased significantly is Venture (171%) and the one that had fallen significantly is Silverlake (-34%).

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

Here's the breakdown of my portfolio according to market value as at 24 April 2018:

I'm quite happy with the current composition as there's no one share counter that appears to dominate my portfolio.

Comments

Sorry for the late reply. Blogger has been experiencing problem with e-mail notification since, apparently, May.

I think it's already too late to give any suggestion. Sorry about that. What I did was to immediately sell it. I didn't want to hold shares in ASX (had concerns same as yours). I didn't want to join the bulk-sell either because it will be leaving entirely up to whoever it is to decide when to sell. I wanted to get the sales proceed a.s.a.p so that I could redeploy it to something else.