Share investment Apr 17 Part 2

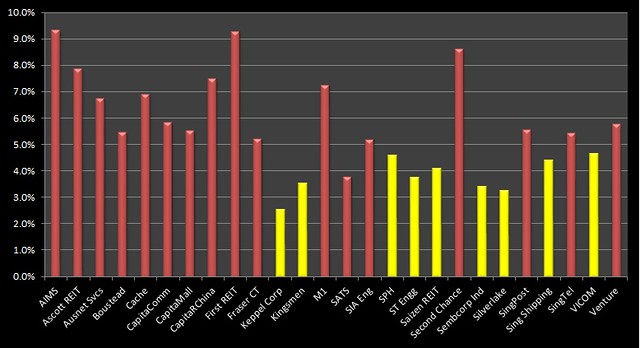

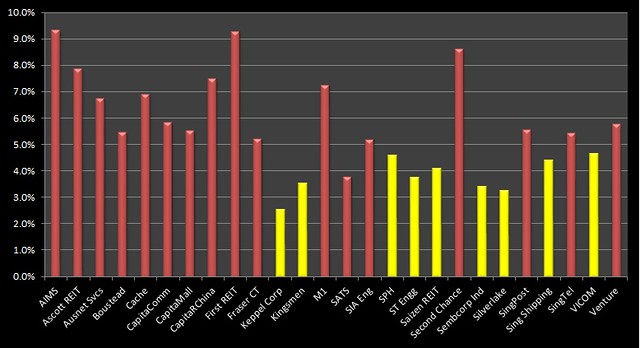

Here are the dividend yields on cost for shares that have paid out dividends:

For ease of calculation, I've changed the method of calculating its denominator and it's erring on the conservative side i.e. likely underestimated.

There are 9 share counters with dividend yield less than 5%. ST Engineering is still yielding than 4% since the last update and it was just above 4% 2 years ago. Hmmm I'll observe for one more year given the change mentioned above. Kingsmen Creative and Silverlake Axis are also put in on my red list haha. Saizen Reit will be delisted soon.

Keppel Corp is experiencing hardship due to downturn in the O&G sector. Hopefully things will pick up soon.

The overall dividend yield on cost weighted by invested amount is now 5.6% but partly affected by the change in calculation method.

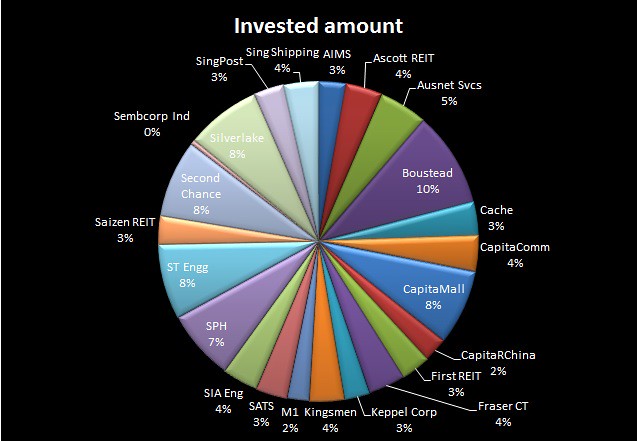

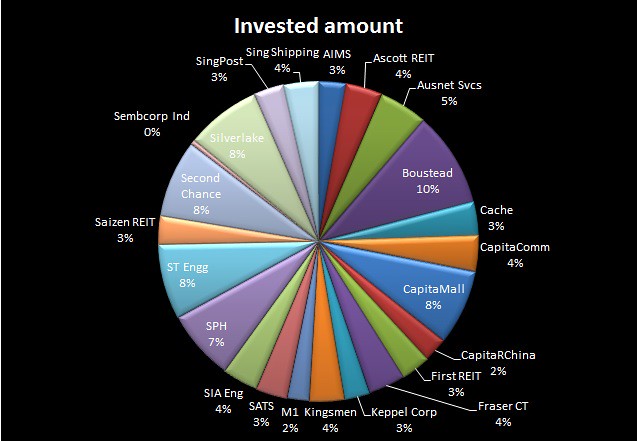

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

Compared to a year ago, I've severely reduced holdings in Sembcorp Industries due to a glitch.

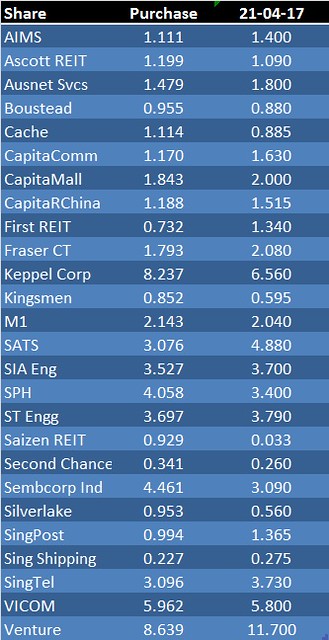

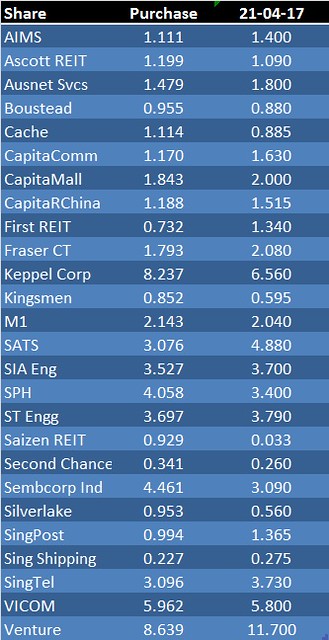

Here is the average cost of each share counter compared to its then prevailing price as at 21 April 2017:

The most significant change is probably the huge increase in price of Venture. Oh wow. Unfortunately, I do not know why haha. Yes, yes, that's bad of me.

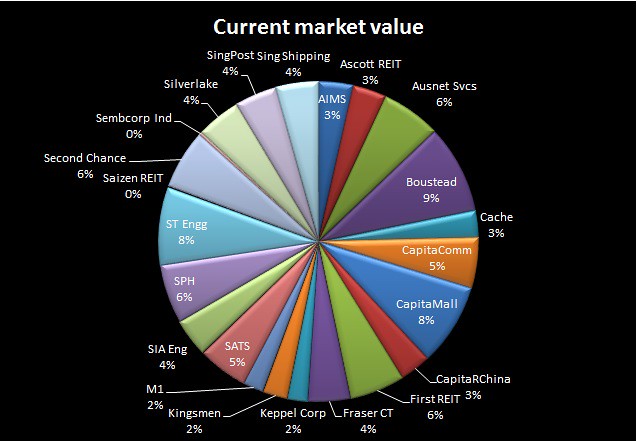

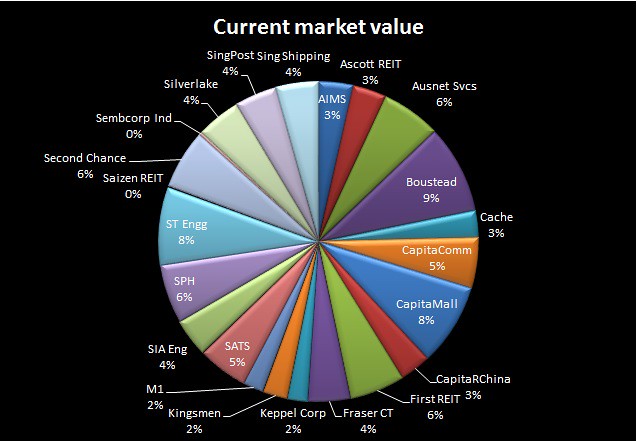

Here's the breakdown of my portfolio according to market value as at 21 April 2017:

This is useful as a starting point for me to look at when deciding what to sell next.

For ease of calculation, I've changed the method of calculating its denominator and it's erring on the conservative side i.e. likely underestimated.

There are 9 share counters with dividend yield less than 5%. ST Engineering is still yielding than 4% since the last update and it was just above 4% 2 years ago. Hmmm I'll observe for one more year given the change mentioned above. Kingsmen Creative and Silverlake Axis are also put in on my red list haha. Saizen Reit will be delisted soon.

Keppel Corp is experiencing hardship due to downturn in the O&G sector. Hopefully things will pick up soon.

The overall dividend yield on cost weighted by invested amount is now 5.6% but partly affected by the change in calculation method.

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

Compared to a year ago, I've severely reduced holdings in Sembcorp Industries due to a glitch.

Here is the average cost of each share counter compared to its then prevailing price as at 21 April 2017:

The most significant change is probably the huge increase in price of Venture. Oh wow. Unfortunately, I do not know why haha. Yes, yes, that's bad of me.

Here's the breakdown of my portfolio according to market value as at 21 April 2017:

This is useful as a starting point for me to look at when deciding what to sell next.

Comments

Ya lor, macam tu lah. Market is not doing well.