Budgeting & Saving

Oftentimes I hear people lamenting about their impotency at saving money. So, when my (then) colleague in Singapore lamented the same thing, I demonstrated to him, in about 5 mins, that he could actually save nearly 50% of his gross salary if he wanted too. He appeared to be truly amazed by this fact.

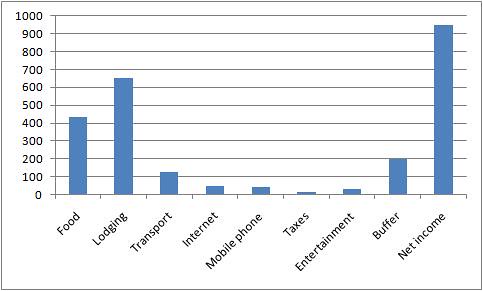

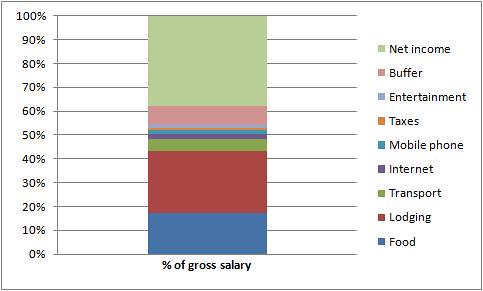

How did I do it? Just purely by budgeting. Here's a more elaborated example: assume a gross salary of S$2,500.

Food

Breakfast: bread with some bread spread, with a loaf of bread lasting for 4 days (i.e. a little more than 3 slices per day). Generous budgeting of S$3 every 4 days i.e. about S$24 per month. You probably can have soft-boiled egg every now and then.

Lunch and dinner: mixed rice for one of these meals and noodle or anything about S$5/S$6 for the other meal, with possibly one drink for one of these meals. Budget of S$10 per day i.e. S$310 per month

Luxury food: Treat yourself to some nicer food, with budget of S$25 per meal, once a week i.e. S$100 per month

Lodging

Current rent for a room, not too close to city centre and yet possibly not too far too, is about S$500 - S$800 per month. Generous budget of S$650 per month.

Transport

Take MRT or bus or a combo. Budget of S$1.40 per trip i.e. S$2.80 per day. Further budget for taxi ride of S$10 per ride and 4 times per month. Total budget for transport is about S$127.

Internet

Budget of S$50 can get you a decent broadband, with broadband speed of at least 6Mbps unlimited.

Mobile phone

Actually, S$28 is more than enough. That's the cost for about every 50 days for a particular type of prepaid plan that's available from all the major telcos of which I could never get to finish the credit for local calls/sms. I ended rolling over local credit worth over S$300!. Even if this info is outdated, I believed a budget of S$45 per month is more than sufficient.

Taxes

Based purely on gross monthly salary of S$2,500, instalment for income tax is S$15 per month. Note that the inland revenue authority in Singapore allows payment to be instalment over 12 months interest free.

Entertainment

Budget of S$32 per month enables you to watch a movie each week for 4 weeks a month, if you get one of those credit cards that enables you to purchase movie ticket at S$8. Even at the original price of S$10, you still get to watch 3 movies a week.

Buffer

A buffer is for those unexpected expenses e.g. your parents are down and you bore all their expenses while they there are there. Budget of S$200 per month.

Net income = gross salary less total expenses.

Based on this budget, net income is over S$900, which is nearly 40% of the gross salary of S$2,500.

That's a lot. In a year, you would have saved over S$10,000.

Some of the reasons, I observed, why some people seem incapable at saving are as follows:

Another cause of failure to follow the budget is the lack of monitoring and feedback process. Expenses should be recorded (preferably on a daily basis lest you forget) using the same categories as the budget (with a useful additional category of "Misc"). Then examine these on a monthly basis to determine the difference between actual expendicture and budget. Reflect on the reasons for any significant discrepancy and take appropriate actions e.g. more discipline approach, budget's too optimistic, more categories to facilitate monitoring etc.

In such task and any other important tasts, it's important to have this monitoring and feedback loop as part of the control cycle: (1) defining the problem (e.g. not saving enough), (2) developing solution (e.g. create a budget) and (3) monitoring and feedback (e.g. record actual expenses and examine them against budget), which then goes back to (1).

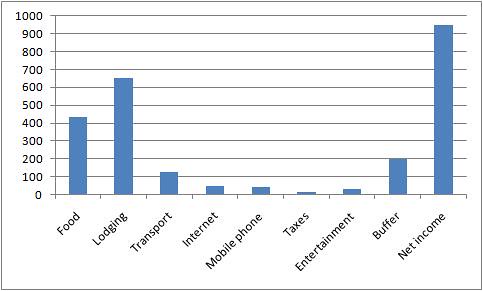

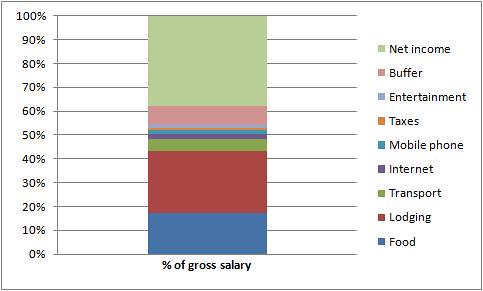

How did I do it? Just purely by budgeting. Here's a more elaborated example: assume a gross salary of S$2,500.

Food

Breakfast: bread with some bread spread, with a loaf of bread lasting for 4 days (i.e. a little more than 3 slices per day). Generous budgeting of S$3 every 4 days i.e. about S$24 per month. You probably can have soft-boiled egg every now and then.

Lunch and dinner: mixed rice for one of these meals and noodle or anything about S$5/S$6 for the other meal, with possibly one drink for one of these meals. Budget of S$10 per day i.e. S$310 per month

Luxury food: Treat yourself to some nicer food, with budget of S$25 per meal, once a week i.e. S$100 per month

Lodging

Current rent for a room, not too close to city centre and yet possibly not too far too, is about S$500 - S$800 per month. Generous budget of S$650 per month.

Transport

Take MRT or bus or a combo. Budget of S$1.40 per trip i.e. S$2.80 per day. Further budget for taxi ride of S$10 per ride and 4 times per month. Total budget for transport is about S$127.

Internet

Budget of S$50 can get you a decent broadband, with broadband speed of at least 6Mbps unlimited.

Mobile phone

Actually, S$28 is more than enough. That's the cost for about every 50 days for a particular type of prepaid plan that's available from all the major telcos of which I could never get to finish the credit for local calls/sms. I ended rolling over local credit worth over S$300!. Even if this info is outdated, I believed a budget of S$45 per month is more than sufficient.

Taxes

Based purely on gross monthly salary of S$2,500, instalment for income tax is S$15 per month. Note that the inland revenue authority in Singapore allows payment to be instalment over 12 months interest free.

Entertainment

Budget of S$32 per month enables you to watch a movie each week for 4 weeks a month, if you get one of those credit cards that enables you to purchase movie ticket at S$8. Even at the original price of S$10, you still get to watch 3 movies a week.

Buffer

A buffer is for those unexpected expenses e.g. your parents are down and you bore all their expenses while they there are there. Budget of S$200 per month.

Net income = gross salary less total expenses.

Based on this budget, net income is over S$900, which is nearly 40% of the gross salary of S$2,500.

That's a lot. In a year, you would have saved over S$10,000.

Some of the reasons, I observed, why some people seem incapable at saving are as follows:

- They're spending beyond their means. Enough said.

- They're spending within their means but barely, mainly because they want the best of everything. They just got to have the latest iPhone, take taxi everywhere, have meals of at least S$10 per meal, the best internet and mobile phone packages etc.

- They want to save more but fail to budget and hence have nothing to adhere to.

- They have a budget but simply fail to adhere to it.

- They have a budget and try to adhere to it but only try to put aside what's left of their salary at the end of the month after having spent on everything else.

Another cause of failure to follow the budget is the lack of monitoring and feedback process. Expenses should be recorded (preferably on a daily basis lest you forget) using the same categories as the budget (with a useful additional category of "Misc"). Then examine these on a monthly basis to determine the difference between actual expendicture and budget. Reflect on the reasons for any significant discrepancy and take appropriate actions e.g. more discipline approach, budget's too optimistic, more categories to facilitate monitoring etc.

In such task and any other important tasts, it's important to have this monitoring and feedback loop as part of the control cycle: (1) defining the problem (e.g. not saving enough), (2) developing solution (e.g. create a budget) and (3) monitoring and feedback (e.g. record actual expenses and examine them against budget), which then goes back to (1).

Comments

Hardly!