Share investment Jun 12 Part 2

(continue from Part 1)

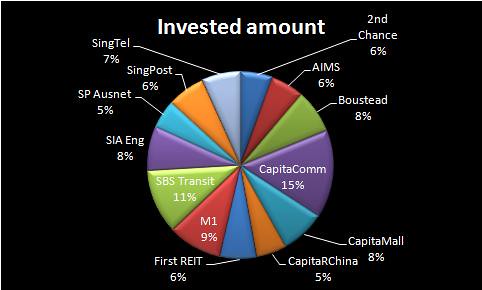

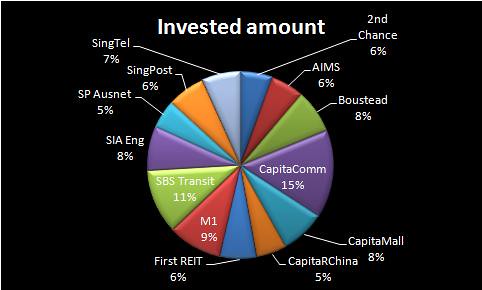

Here's a breakdown of where my investment went to:

Here's the average purchase price and the closing price on 28 Jun 2012:

Here's the historical dividend yield:

The annualised dividend yield for a share was calculated as sum of the actual dividend yields (actual dividend yield = amount of dividend paid divided by invested amount) pro-rated to a year. This was done sensibly by taking account of the frequency and timing of the dividend payment.

Shares with dividend history of less than a year were excluded.

Here's a breakdown of where my investment went to:

Here's the average purchase price and the closing price on 28 Jun 2012:

Here's the historical dividend yield:

The annualised dividend yield for a share was calculated as sum of the actual dividend yields (actual dividend yield = amount of dividend paid divided by invested amount) pro-rated to a year. This was done sensibly by taking account of the frequency and timing of the dividend payment.

Shares with dividend history of less than a year were excluded.

Comments