Share Investment Apr 15 Part 2

(continue from Part 1)

Here are the dividend yields on cost for shares that have paid out dividends equivalent to a year:

Except for 4 of them (indicated by the yellow-coloured bars), the rest fulfilled my criteria of 5% dividend yield. I'll observe how SBS Transit will fare especially after the expected sale of infrastructure and operating assets to the government in the next few years. As for the remaining 3 exceptions, I consciously bought them knowing the then dividend yields were above 4% but below 5%. Of course I hope the yield on cost will go up in future with increase in dividend per unit ("DPU").

The overall dividend yield on cost weighted by invested amount is 6.0%. That's good :)

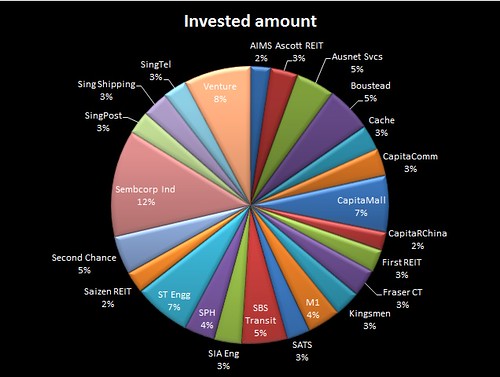

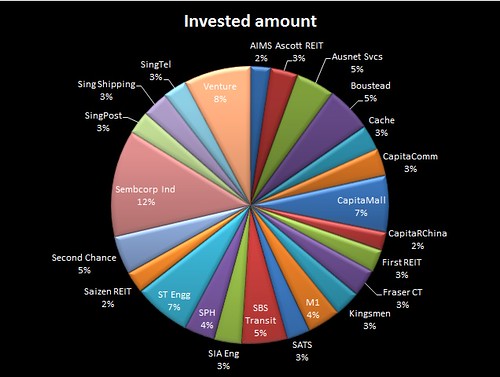

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

As stated in Part 1, I bought more Sembcorp Industries share and so its invested amount % now exceeds 10%. I'll reduce it to below 10% when it's back in the black (just as I've done with SBS Transit previously).

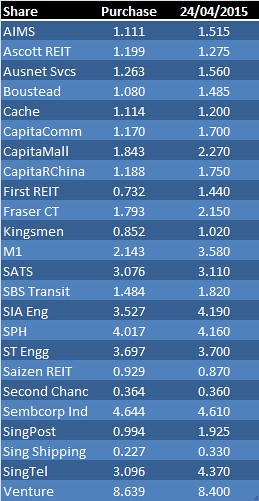

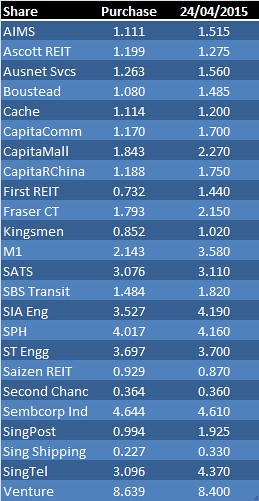

Here is the average cost of each share counter compared to its then prevailing price as at 24 April 2015:

As stated in Part 1, SBS Transit share price rebounded significantly and now it's in the black (i.e. exceeds my average purchase price). Venture's share price has also rebounded but still short of the purchase price. Saizen, Second Chance and Sembcorp are in the red.

Here are the dividend yields on cost for shares that have paid out dividends equivalent to a year:

Except for 4 of them (indicated by the yellow-coloured bars), the rest fulfilled my criteria of 5% dividend yield. I'll observe how SBS Transit will fare especially after the expected sale of infrastructure and operating assets to the government in the next few years. As for the remaining 3 exceptions, I consciously bought them knowing the then dividend yields were above 4% but below 5%. Of course I hope the yield on cost will go up in future with increase in dividend per unit ("DPU").

The overall dividend yield on cost weighted by invested amount is 6.0%. That's good :)

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

As stated in Part 1, I bought more Sembcorp Industries share and so its invested amount % now exceeds 10%. I'll reduce it to below 10% when it's back in the black (just as I've done with SBS Transit previously).

Here is the average cost of each share counter compared to its then prevailing price as at 24 April 2015:

As stated in Part 1, SBS Transit share price rebounded significantly and now it's in the black (i.e. exceeds my average purchase price). Venture's share price has also rebounded but still short of the purchase price. Saizen, Second Chance and Sembcorp are in the red.

Comments