Share investment Mar 14 Part 2

(continue from Part 1)

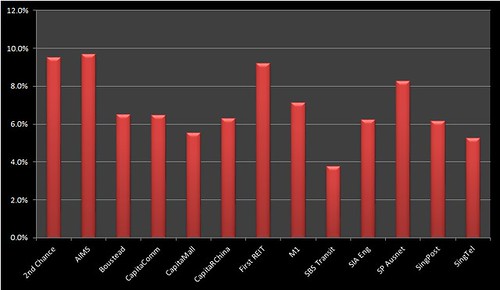

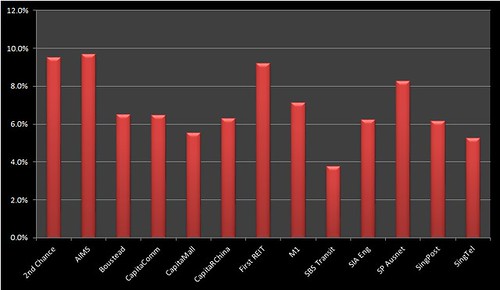

Here are the dividend yields on cost for shares that I've held for at least 1 year:

All of them fulfill my criteria of 5% dividend yield except for SBS Transit, where its price has dropped a lot compared to the my average cost and so unsurprisingly its dividend has also dropped over the years.

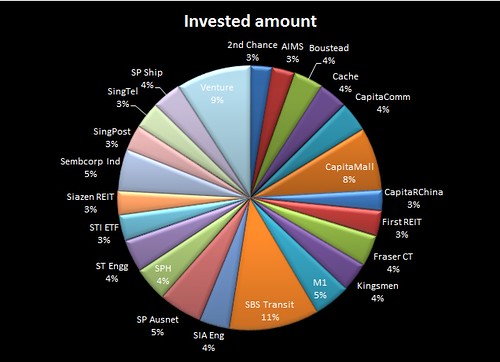

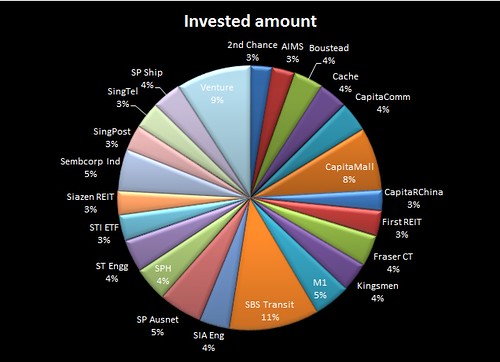

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

SBS Transit now occupies the biggest piece of the pie but still at a smallish percentage of 11%. This is due to my additional purchase of the shares when its price dropped to at least 20% below the average cost. Hmmm I should probably try to keep the percentage to not more than 10%.

Here is the average cost of each share counter compared to its then prevailing price as at 12 March 2014:

As you can see, price of SBS Transit has fallen by a lot compared to the average cost. I hope I'm not making a mistake here by continuing to invest in it. Venture is another concern but at least I understand that its 2013 4th quarter's result was pretty good.

Here are the dividend yields on cost for shares that I've held for at least 1 year:

All of them fulfill my criteria of 5% dividend yield except for SBS Transit, where its price has dropped a lot compared to the my average cost and so unsurprisingly its dividend has also dropped over the years.

Here's the breakdown of my portfolio according to percentage of amount of investment in each share counter:

SBS Transit now occupies the biggest piece of the pie but still at a smallish percentage of 11%. This is due to my additional purchase of the shares when its price dropped to at least 20% below the average cost. Hmmm I should probably try to keep the percentage to not more than 10%.

Here is the average cost of each share counter compared to its then prevailing price as at 12 March 2014:

As you can see, price of SBS Transit has fallen by a lot compared to the average cost. I hope I'm not making a mistake here by continuing to invest in it. Venture is another concern but at least I understand that its 2013 4th quarter's result was pretty good.

Comments